Hedging on the Energy Markets and the Potential Liquidity Need Under Adverse Market Conditions

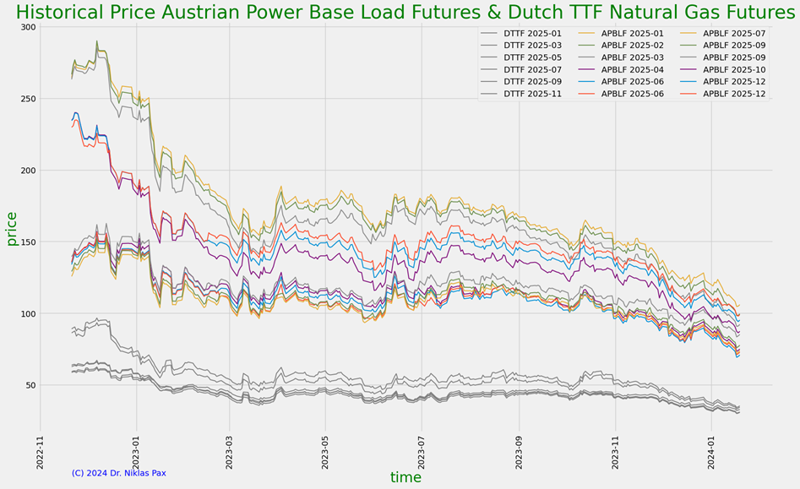

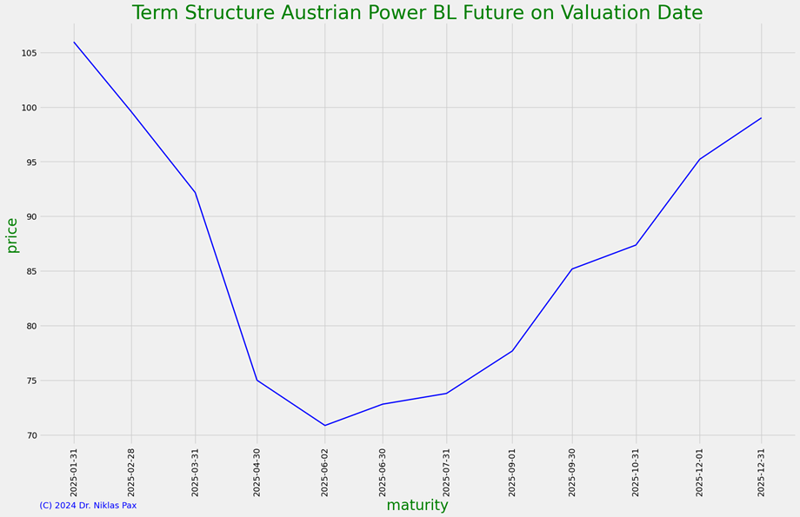

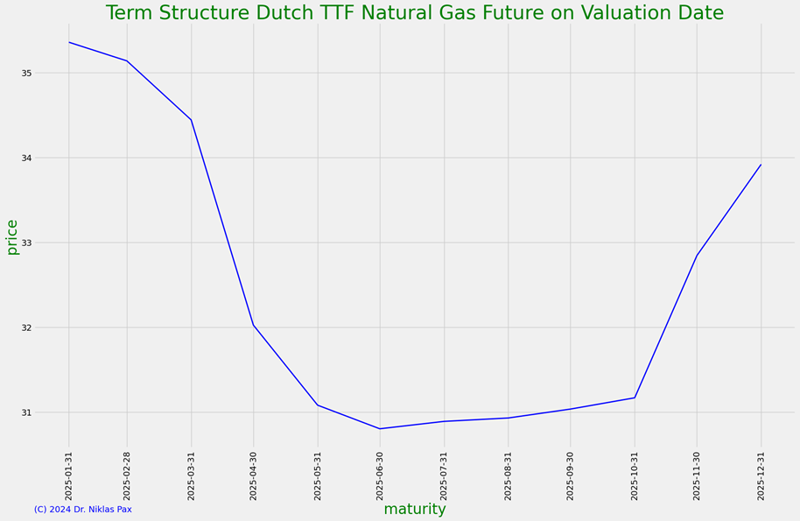

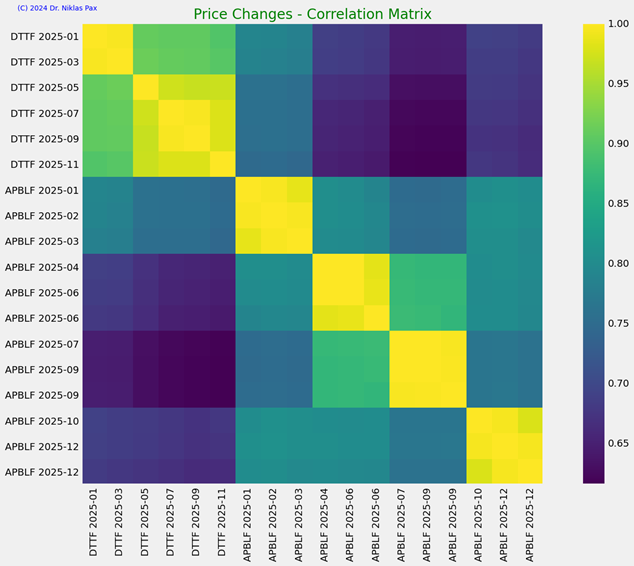

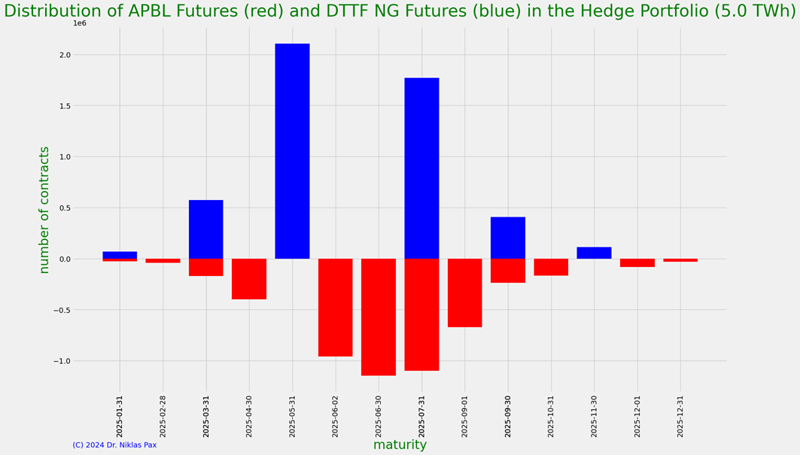

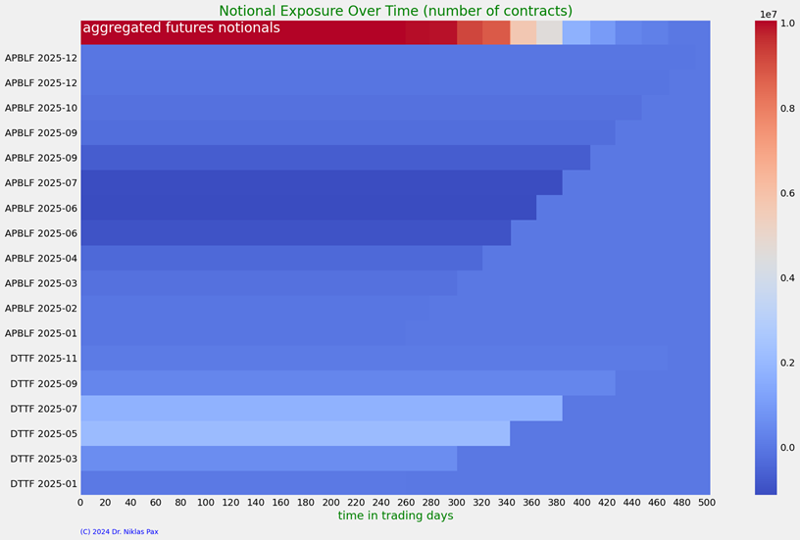

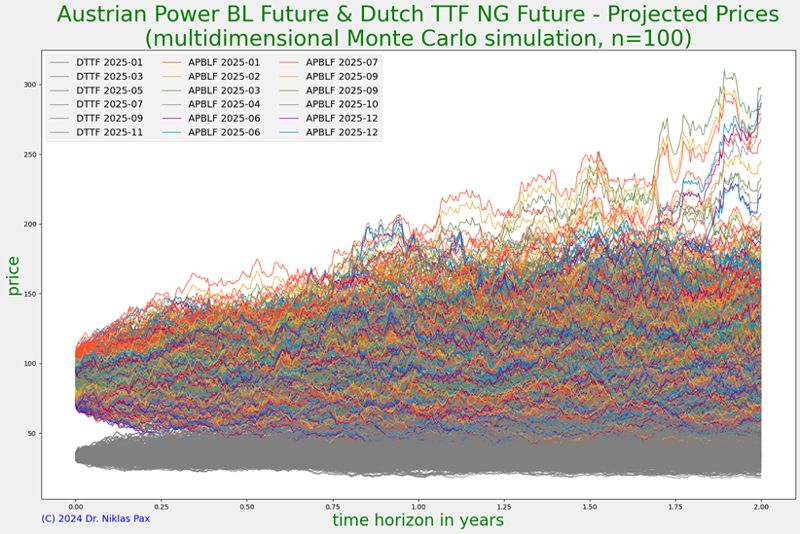

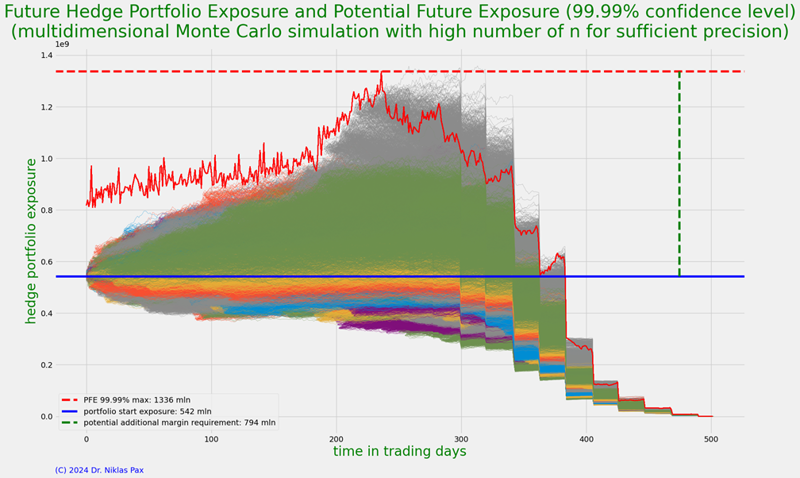

An electricity producer operating combined cycle gas turbines (CCGT) power plants sells a part of next year's production of electricity in the futures market and hedges the production cost using futures on natural gas. During the lifetime of the hedge portfolio, adverse price developments can lead to sudden additional margin requirements issued by the commodity exchange and the clearing house. These requirements have to be met by the electricity producing company and result in additional liquidity needs. Here, a model is developed for an ex-ante estimation of the hedge portfolio's potential future exposure (PFE) at a confidence level of 99.99 %. The model relies on mean reverting stochastic processes and the calculations are carried out using a multidimensional Monte Carlo simulation. The PFE is the basis for calculating daily margin requirements.